form 8 ssm

Though filing is free you are required to send the completed form to the following address. You can file this form immediately or your worker can file the form themselves if they disagree with your definition.

Particulars of Form 8.

. Form 8 has two. Guide Sample of Completed Form. Functional Abilities Form FAF A Functional Abilities Form FAF for Early and Safe Return to Work PDF provides information about your patients abilities.

Regardless of who files the initial Form SS-8 both parties are asked to complete the form. Certificate Of Incorporation Of Public Company. Request for Transcript of Tax Return Form W-4.

Double check all the fillable fields to ensure complete accuracy. How to file Form SS-8. A copy of the licence under section 451 CA 2016 a copy of the licence pursuant to section 241 CA 1965 Form 15 and the licence.

Apply a check mark to point the answer where needed. A Form SS-8 that is not properly signed and dated by the taxpayer cannot be processed and will be returned. Class Adviser MAPEH Teacher School Nurse or other qualified personnel.

Applications must be submitted online. A copy of the current CLBGs Constitution without amendment. Do not submit the form with your tax return.

Your patient and their employer will use this information as a tool for planning a return to suitable work. Amendment of Date of Coverage - All of the following. The form ensures that workers are correctly identified from day one.

Form SSA-8 Information You Need To Apply For Lump Sum Death Benefit. Send Form SS-8 on its own. Notice of Termination for a Registered Business.

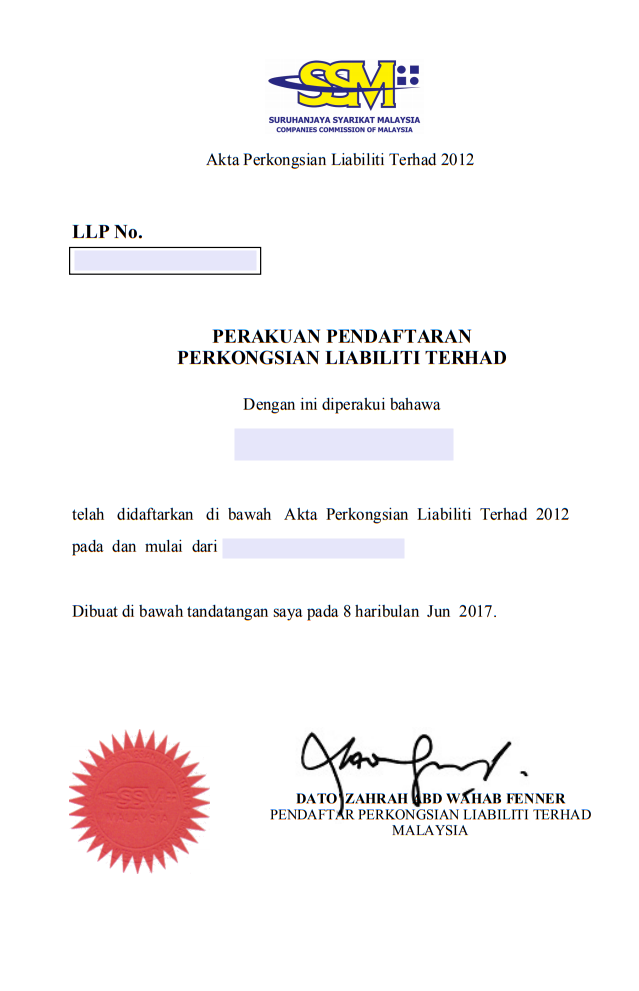

A copy of the Certificate of Incorporation Form 8 Notice of Registration. By Mark Anthony Llego. Employers Quarterly Federal Tax Return Form W-2.

APPLICATION FOR LUMP-SUM DEATH PAYMENT I apply for all insurance benefits for which I am eligible under Title II Federal Old-Age Survivors and Disability Insurance of the Social Security Act as presently amended. Ad Access IRS Tax Forms. 412 Notice of conversion from a private company to a public company.

Filed Form SS-8 with the Internal Revenue Service Office in Holtsville NY. For more information about UCFEUI read the REVERSE SIDE of this form. You can check out the clarifications on the old and new statutory documents which are listed in Schedule A B and C together with attached sample documents.

You can apply for benefits by calling our national toll-free service at 1-800-772-1213 TTY 1-800-325-0778 or by visiting your local Social Security office. The SSM has published a detailed explanation in the introduction of the Companies Act 2016. Firms and workers file Form SS-8 to request a determination of the status of a worker for purposes of federal employment taxes and income tax withholding.

There is no fee for filing. Write Protective Claim at the top of the form sign and date it. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Merger - Certificate of Filing of Articles of Merger issued by the SEC. Box 630 Stop 631 Holtsville NY 11742-0630 Faxed photocopied or electronic versions of Form SS-8 are not. Employers engaged in a trade or business who pay compensation.

Or suite no city state and ZIP code. The advanced tools of the editor will lead you through the editable PDF template. Complete Edit or Print Tax Forms Instantly.

A request for the form should only be initiated by the employer or your. Guide Sample of Completed Form. You cannot electronically file Form SS-8 or send it via fax.

In addition enter the following statement in Part III. Where To File Send the completed and signed Form SS-8 to. Guide Sample of Completed Form Registration of changes in Business Particulars.

Guide Sample of Completed Form. Form 8-A with the Commission the qualification of the Regulation A offering statement or the receipt by the Commission of certification from the national securities exchange listed on this form. Please note that the processing time will take about 5.

The Application for Registration more. KEEP THIS FORM and TAKE IT WITH YOU if you file a UCFEUI claim for unemployed Federal workers provided by Federal law US. You need to use a real signature at the end of the form and write in the date.

Utilize the Sign Tool to add and create your electronic signature to signNow the SSA 8 form. School Form 8 Learners Basic Health and Nutrition Report SF8 Person Responsible. Employees Withholding Certificate Form 941.

This is important because if your worker is unhappy with their classification they can initiate an investigation and determination with the IRS. CODE Title 5 Chapter 85. Application for Renewal of Business Registration.

Do not leave any blank. Social Security Administration Page 1 of 4. On the Form 1040X you file do not complete lines 1 through 23 on the form.

For please tick where appropriate. -Employer Registration SS Form R-1Employment Report SS Form R-1A that will supersede the initial submission -. CERTIFICATE OF INCORPORATION OF PUBLIC COMPANY.

Request for Taxpayer Identification Number TIN and Certification Form 4506-T. Indicate Not applicable or NA where necessary. Form SS-8 can be completed by you the employer hiring the worker or by the worker themselves.

According to the IRS that will likely cause delays in processing time. Ad Access IRS Tax Forms. FORM 8 APPLICATION FOR AN EMPLOYMENT S PASS INSTRUCTIONS.

Stamps are not acceptable. Every LLP registered on or before 30 th September is required to mandatorily file a statement in Form 8 for the Financial Year ending on 31 st March. Complete Edit or Print Tax Forms Instantly.

File a separate Form 1040X for each year. A copy of the CLBGs Constitution inclusive of amendment. Enter your official contact and identification details.

Up to 32 cash back SS-8 Determinations. Previously known as Form 24 Form 44 and Form 49. Internal Revenue Service Form SS-8 Determinations PO.

Applicability of Form 8. PO Box 630 Stop 631. Ad With airSlate you can archive your documents immediately after theyve been completed.

Companies Act 1965 Section 16 4 Company No. Form SSA-8 01-2020 UF Discontinue Prior Editions. Section 241 of the Companies Act 2016 comes into operation on 15 March 2019.

Instructions for Form 1040 Form W-9. Create edit fill and send documents for e-signing in a single airSlate workspace. Filing a Form SS-8 requesting a worker status determination means you or the firm is asking the Service to establish if the services you provide to the firm are those of an employee or.

11-2006 Name of firm or person for whom the worker performed services Workers name Firms address include street address apt. For all grade levels Kinder included School Form 8 Learners Basic Health. NSN 7540-00-634-3964 CODE NO.

Resumption of Operation - SS Form R-1A reporting for coverage newly hiredre-hired employees. Within 1stQuarter of School Yearor as needed. Form SS-8 otherwise known as Determination of Worker Status uses a series of factors to differentiate between contractors and temporary employees.

FEDERAL AGENCY Identification 3 Digit To be completed by the Federal Agency. Form 11 18. Applications must be submitted online through https.

Or 2 For the registration of a class of securities under Section 12g upon the later of. An appointment is not required but if you call ahead and schedule one it may reduce the time you spend waiting to. However if LLP is registered after 30 th September has an option to file a statement in Form 8 for the Financial Year ending on 31 st March of that year.

Form 8 Download Printable Pdf Or Fill Online Notice Of Discontinuance Withdrawal Queensland Australia Templateroller

Required Documents To Register Senangguide

Georgesharp Twitter Search Twitter

Mco News Updates Suruhanjaya Syarikat Malaysia

Quality Non Conformance Report Template 7 Professional Templates Report Template Templates Report

Form 8 Download Printable Pdf Or Fill Online Notice Of Discontinuance Withdrawal Queensland Australia Templateroller

No comments for "form 8 ssm"

Post a Comment